When it comes to managing your Medicare Part D coverage, having all of your questions answered about open enrollment is important.

Final decisions about your Medicare coverage will depend on things such as each person’s differing circumstances, supporting facts, regional variations, and any possible changes in the future.What is Open Enrollment?

We want to provide you with all the basic information you may need to know, along with other frequently asked questions about Medicare Part D open enrollment.

What is Open Enrollment?

When it comes to answering all of your questions about open enrollment for Medicare Part D, the first step is making sure you understand what exactly open enrollment is.

When is the Open Enrollment Period?

Medicare Open Enrollment is a period of time (October 15-December 7), where already current Medicare patients can choose whether or not to change/supplement their Medicare coverage.

Users can evaluate their coverage and compare it to other Medicare package plans. Determining whether or not they’re using the plan best fit for their needs. During this time it’s an option to drop, switch, or add a Medicare Advantage and/or Part D Plan.

The Open Enrollment Period may not be used to enroll in Part A and/or Part B for the first time.

During the Open Enrollment Period the following may happen:

- Anyone who has, or is signing up for Medicare Parts A or B can join or drop a Part D prescription drug plan.

- Anyone with Original Medicare (Parts A & B) can switch to a Medicare Advantage plan.

- Anyone with Medicare Advantage can drop it and switch back to just Original Medicare (Parts A & B).

- Anyone with Medicare Advantage can switch to a new Medicare Advantage plan.

Anyone with a Part D prescription drug plan can switch to a new Part D prescription drug plan(MyMedicare).

When Should You Consider Switching Plans?

Every year it’s possible for insurance companies to change their Medicare plans. This can possibly impact your out-of-pocket costs; deductibles, monthly premiums, drug costs, available networks, etc. It’s also possible for them to adjust the list of covered drugs for your plan.

With these yearly changes happening, re-evaluating your Medicare plan every year is beneficial to you. Making sure you’re still holding the best plan for your personal needs.

Other Benefits of Re-Evaluating Your Coverage:

- Switching to better prescription drug coverage can reduce out-of-pocket costs and ensure drug plans still cover needed prescriptions.

- Save money and keep your doctor in-network by switching Medicare Advantage or Part D plans. Research shows that the average consumer can save $300 or more annually if they review their Part D coverage.

- Find a higher quality plan. Plans with a 5-star rating are considered high quality. If you are enrolled in a plan that is less than 3, consider using Open Enrollment to switch.

Anyone who has Medicare can get prescription drug (Part D) coverage, including people ages 65 and older who are U.S. citizens or permanent residents, and people below the age of 65 who have certain disabilities.

If you are already enrolled in Medicare Part D and don’t wish to change any parts of your coverage, you don’t need to do anything during open enrollment.

However, if your plan isn’t eligible for renewal, or is being discontinued, you’ll be notified prior to the open enrollment period.

How to be Prepared for Open Enrollment

If you’re wondering how to prepare yourself for the process of changing your Medicare plan, the first step is to compare coverage plans to your current one.

Starting in October, all members must be sent the Annual Notice of changes for Medicare Advantage and drug plans. This includes a summary of costs that will start taking effect January 1 of the new year and any changes to your current benefit plan.

They may also include Evidence of Coverage, which is an in-depth look at your plan and it’s costs for the coming year.

The best thing to prepare yourself for Open Enrollment from there is to then compare your new information with your current plan. This may include documents of the new plans you’ve received and putting them up against your current plan. Keep your eyes open for any changes in coverage.

Plan Changes to Look out For

- The Monthly Premium

- The Annual Out-of-Pocket Spending Limit

- The Annual Deductible

- Your Out-of-Pocket Costs (copayments, coinsurance)

- Network of Providers

- Star (quality) Ratings

- Optional Benefits (such as vision or dental coverage)

A drug plan may change:

- The Premium

- The Formulary

- The Tier of a Medication

- The Annual Deductible

- Copayments or Coinsurance

- Coverage Rules

- Coverage of Medications in the Coverage Gap,

(sometimes known as the donut hole) - Network of Pharmacies

Important Dates to Remember

With different deadlines and a set timeline of how things work, there are a few important calendar days to keep track of when looking at Medicare Open Enrollment.

Starting with Mid September to about October 1st, keep your eye out for the Medicare & You booklet in the mail.

This will hold important information about your current Medicare coverage and any annual changes that will occur on January 1st.

Comparing the changes to the type of coverage you need will help determine whether or not you should take advantage of the upcoming open enrollment period.

Following that time period, be ready for all of the Medicare, Medigap and prescription drug plans marketing efforts. These Medicare Supplement plans will be targeting current Medicare holders for changes in their coverage.

We recommend that from about October 1st to mid October, take the time to compare your plan against others for the upcoming years coverage.

As mentioned earlier, compare things such as:

- Drug Costs

- Benefit Changes

- Drug Information

- Plan Quality Ratings

For an easier way to compare plans, try utilizing Medicare.gov and the Medicare Plan Finder.

At Utah Family Pharmacy we’re ready and willing to compare all of the Medicare Advantage Plans for you! Making the process of choosing the best one for you quick and easy.

Next, from about mid-October to December 7th if you’ve decided to take action and make changes to your plan, then is the time.

To make these changes, your can either:

- Call 1-800-Medicare,

- Fill out/mail printed enrollment form,

- Or visit Medicare.gov.

If you choose to not make any changes, your current plan will be automatically re-enrolled.

January 1st will mark the beginning of your chosen Medicare Plan taking effect.

When you enroll in a new plan, you will be automatically unenrolled from your previous plan. No further action is needed.

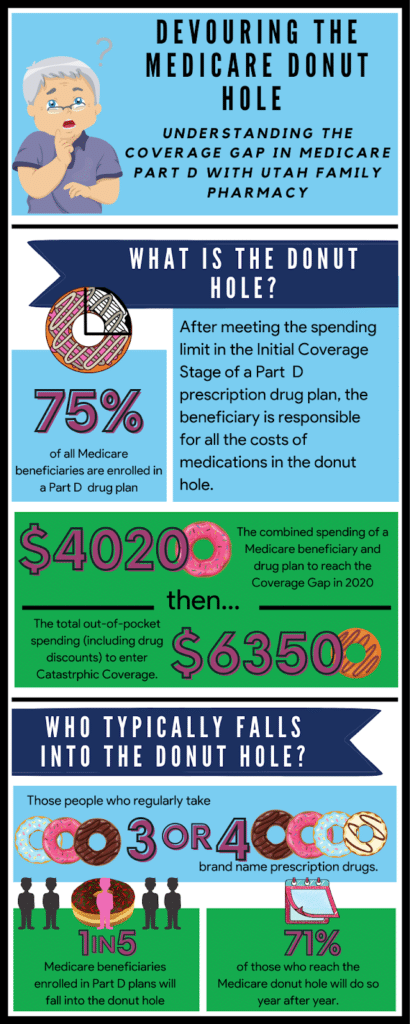

The Medicare Donut Hole Defined

To simplify the process and go over coverage, we’ve gone in depth to explain what exactly is the ‘Medicare Donut Hole’?

Recent Comments